The Biggest Obstacle Standing Between Women and Financial Freedom

It’s probably not what you think so I’m going to cut right to the chase. There’s a saying that we have met the enemy and the enemy is us. Yes, after working with hundreds of women, I have come to believe that the biggest obstacle standing between us and achieving wealth and financial freedom is us.

So many of us have bought into the belief that we don’t have the brainpower, the innate skills, that it’s a math thing or a man thing, or some other made-up thing, and we don’t even give ourselves permission to try. And, if you believe you can’t invest to achieve wealth or create the life you want to live for yourself, then then you can’t because your beliefs are that powerful. On the other hand, if you challenge that belief and turn it around because it’s simply not true, there is basically no limit to the things you can accomplish. I mean think about… seriously, think about it, if a man can do it, is there any sane reason why you can’t?

As women, we’ve made tremendous advances in the workplace, in business, in government, in sports, in you name it, yet many of our core beliefs and behaviors have remained unchanged, especially when it comes to money. For instance, we know that in general, men make more than women even for the exact same job and qualifications. Studies show that white women earn about $0.82 for every $1 men earn and that amount is even less for black and brown women for no attributable reason. And, even though there’s not a lot we can do about the pay gap, we need to understand the impact and account for it.

For example, since we tend to live longer and we have less to work with because we earn less, managing our money is one of the most important things we can do to ensure that we can take care of ourselves. A report by Closing the Women’s Wealth Gap Studies also shows that for every $1 a man owns or has saved for retirement, women have just $0.32. So, we have a lot of ground to make up. Yet, we sometimes turn this task over to others and walk away thinking that that’s one more thing off our plate, but it’s not that simple.

While the impact may not be immediate, it’s estimated that 80 percent of us will have the role of sole financial decision maker at some point in our lives. Therefore, it’s more important than ever to become moneywise – to be an active participant in managing your money whether you’re married or single. Gone are the days when you can totally rely on others to look out for your best interests. Because ready or not, you will eventually have to live with the consequences, the bad as well as the good so you may as well play a starring role.

So Where Should You Start?

Start by educating yourself. Read. Attend seminars and webinars. Listen to podcasts. Start investing and if you make mistakes, learn from them and keep going. Remember, even the experts make mistakes. Work with a fiduciary advisor – someone who will look out for your best interests. In other words, don’t just sit there – do something!

If you have questions, click on the link below and let’s talk. As a fiduciary advisor, financial education fits squarely in my wheelhouse.

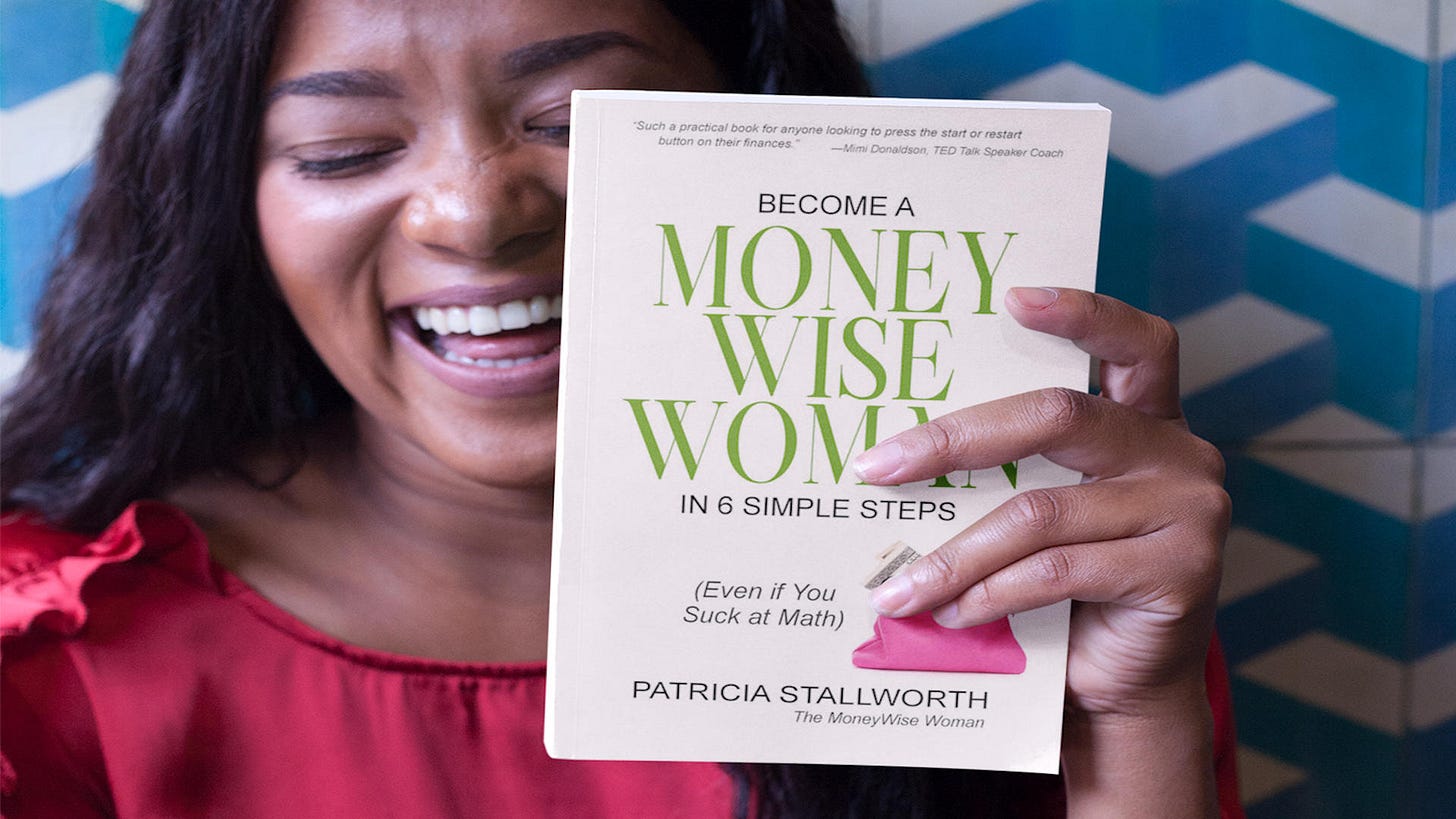

Why Become a MoneyWise Woman?

To be clear, becoming a moneywise woman (MW) is not just about having more money than you know what to do with and accumulating a lot of stuff or even achieving a certain status (although that can be part of it if that’s your goal). Instead, it’s about understanding the real power of what money provides, and that’s freedom. Freedom to not have to worry about money all the time. Freedom to wake up every day and do whatever makes your heart sing. Freedom to offer your gifts and talents to the world—to fulfill your life’s purpose.

In other words, being an MW means that you’re on the journey to financial freedom or financial independence, that place where you have control over your money and you have enough to live life on your terms.

The good news is, it may not be as difficult as you think to accomplish this awesome goal. Your life today is a result of the choices you made yesterday, and your life tomorrow will be the result of choices you make today. While we can’t go back and change the past, the possibilities for the future are endless, and you get to choose your path. You can choose to live life on your terms, to work because you want to not because you have to; to make a good life for you and your family; to help others and organizations you care about; to do basically whatever you choose.

About the ‘Wise’ Part of Money Wise

The “wise” part of being a moneywise woman refers to your ability to make conscious choices with your money today that lead you to the life you want to live tomorrow.

Becoming an MW is not a get-rich-quick scheme or an overnight transformation. In fact, depending on where you’re starting and your definition of financial freedom, it may take some time to arrive. So, think of this as a long, long, long car trip—one where you stop along the way to enjoy each part of the journey instead of one where you rush to get there as fast as possible. After all, the goal of becoming an MW, of achieving financial freedom, is not one where you arrive one day and then you move on the next. It’s a state of being, not a specific destination. So, once you arrive, the goal is to remain there forever!